Stop Holding Other People's Money. Automate Payment Splits. Build Trust.

Fintiq splits every transaction in real-time—so everyone sees their earnings instantly and platforms never touch the funds.

No more "I'll pay you next week." Each transaction splits automatically. Everyone sees their balance instantly. Everyone gets paid on time. Zero manual work.

Built by the team behind payment infrastructure serving millions in transactions

Who it's for

Built for Platforms That Share Payments with Multiple Recipients

Fintiq provides easy-to-use tools for platforms and marketplaces to automate compliant and transparent payment distribution to your recipients, such as:

- Vendors and sellers — Businesses or individuals selling products or services through your platform

- Service providers and contractors — Professionals, freelancers, or specialists performing work for end customers

- Employees and teams — Staff members receiving distributed compensation, tips, or commissions

- Partners and affiliates — Revenue-sharing collaborators, referral sources, or commission earners

Whether you're a food delivery platform, salon booking system, tip distribution service, commission split marketplace, or any platform that needs to split revenue to 2 recipients or 10,000+—across a single category or multiple types separately or simultaneously—Fintiq automates the entire payment workflow while keeping you compliant.

Features

Powerful Features for Payment Distribution

Platform Benefits

Why Platforms Choose Fintiq for Payment Distribution

Replace manual spreadsheets and compliance headaches with automated fund distribution that scales with your platform.

How Fintiq Automates Payment Splits in Real-Time

From API call to ACH transfer in 1-2 business days—with zero manual work for your platform

Step 1

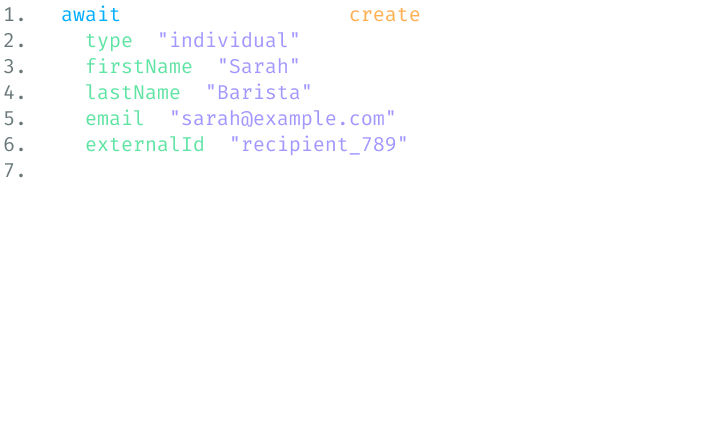

Create accounts via API

Call our API to provision merchant and recipient accounts instantly. They self-onboard via invitation link with all required information.

Step 2

Get dedicated account numbers

Fintiq issues unique account and routing numbers for each merchant to give their processor. Works with Stripe, Square, or any provider.

Step 3

Define splits per transaction

Your platform specifies how to split each transaction using fixed amounts or percentages. Fintiq updates all balances in real-time.

Step 4

Receive automatic ACH payouts

Recipients get ACH transfers to their verified bank account on their chosen schedule—daily or monthly—while you stay out of the flow.

Step 5

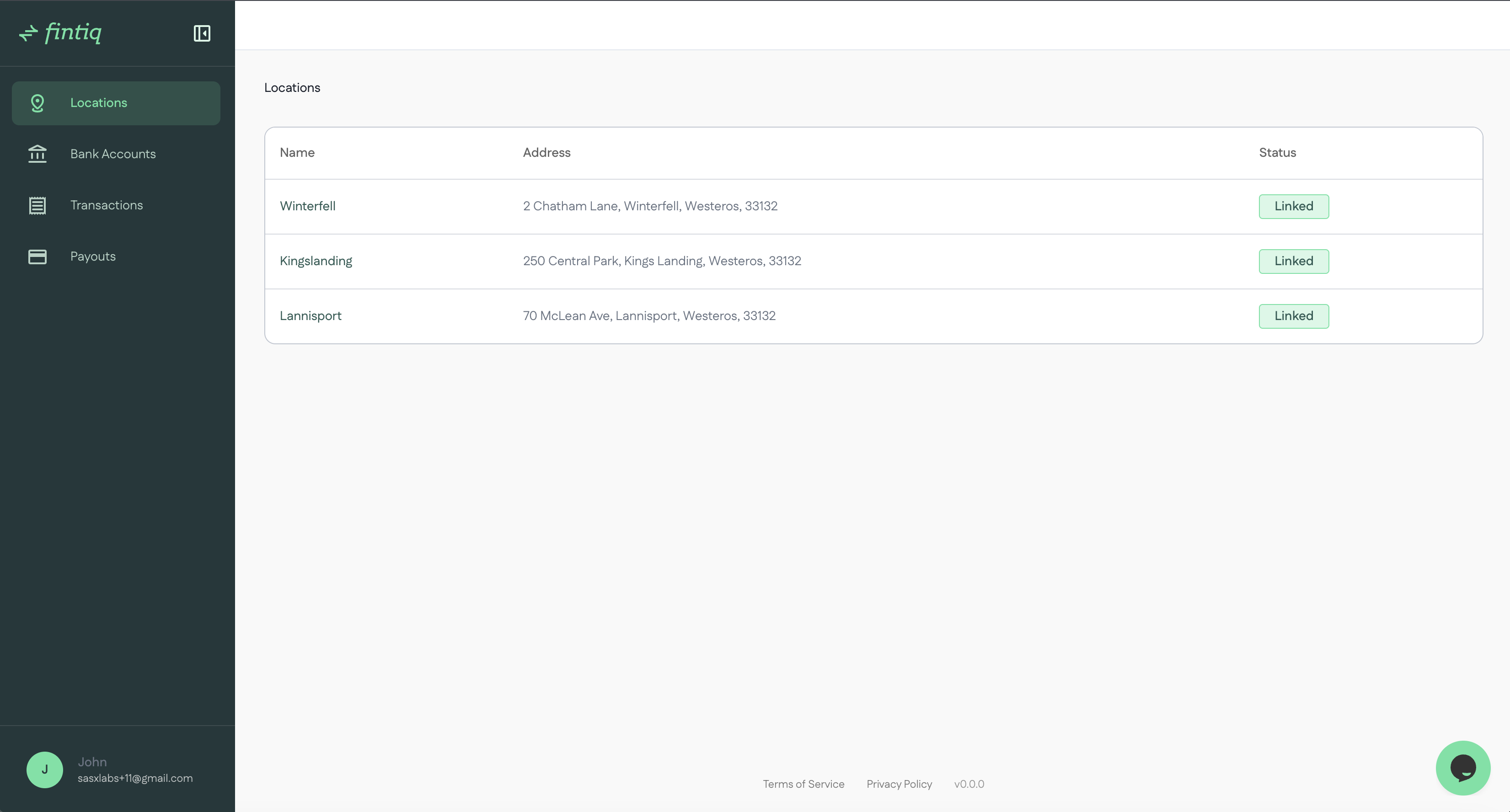

Manage payouts via dashboard

Recipients use the self-service dashboard to link bank accounts, choose payout schedules, and view their complete balance history.

How to avoid money transmitter licensing

Avoid Money Transmitter Licensing with FBO Accounts

Platforms that hold or transfer funds typically need money transmitter licenses—a complex, expensive process requiring state-by-state applications and ongoing compliance obligations.

Fintiq's FBO (For Benefit Of) architecture keeps your platform out of the money flow entirely:

- Your platform never touches funds – Money flows directly through our regulated banking partner, so you avoid becoming a money transmitter

- No licensing required – You provide allocation instructions as software, not financial services

- Full compliance handled – We manage KYC/AML verification, sanctions screening, and audit-ready transaction trails

We handle the banking infrastructure and regulatory compliance so you can focus on building your product.

Why Platforms Choose Fintiq for Payment Splits

Avoid building banking infrastructure. Skip money transmitter licensing. Launch in weeks with a simple API.

Works with any payment processor

We provide account numbers where your processor deposits funds. Compatible with Stripe, Square, and all major payment providers.

Launch in 2-4 weeks

Simple API integration gets you live fast, without building banking infrastructure or waiting for licensing approvals.

Compliance burden handled

We partner with regulated financial institutions so you avoid licensing requirements and stay out of money transmitter obligations.

Real-time visibility and control

Recipients see earnings instantly and verify their own bank accounts for direct payouts on their schedule.

Invite recipients via API and they receive a secure onboarding link to self-verify their bank account—no manual setup or support tickets required.

Merchant Onboarding

No Merchant Technical Integration Required

Your platform invites merchants via API. They onboard through a secure link, receive dedicated account numbers, and connect their payment processor—no technical setup needed.

Your platform creates merchants with one API call. Fintiq handles the complete onboarding flow through a self-service portal.

- Self-service KYB onboarding – Merchants receive a secure link to complete their business profile and pass KYB verification automatically without platform involvement

- Dedicated account and routing numbers – Each merchant location receives unique Fintiq account numbers to give their payment processor for fund deposits

- Link payout bank account – Merchants connect their own bank account where they'll receive their allocated portion after automatic fund distribution

- Real-time dashboard visibility – Merchants see all transaction allocations, incoming funds, and payout history in their dedicated portal without manual calculations

Your platform controls fund allocation via API—merchants receive their portion automatically via ACH to their linked bank account.

Platform Use Cases

See How Fintiq Solves Payment Splits for Your Industry

Real solutions for platforms that share revenue across multiple parties

Restaurants and tip pooling

Community and cultural events

Ski resorts and adventure parks

Investment platforms

Country clubs

Boat and yacht rentals

Rental marketplaces

Hotels and resorts

Online course and webinar platforms

Equipment leasing and rental systems

Restaurant and café franchises

Cleaning and facility services

Film and production revenue sharing

Payment facilitators

Sponsorship campaign platforms

Real estate brokerages

Crowdfunding platforms

Charity and donation platforms

Restaurants and tip pooling

Community and cultural events

Ski resorts and adventure parks

Investment platforms

Country clubs

Boat and yacht rentals

Rental marketplaces

Hotels and resorts

Online course and webinar platforms

Equipment leasing and rental systems

Restaurant and café franchises

Cleaning and facility services

Film and production revenue sharing

Payment facilitators

Sponsorship campaign platforms

Real estate brokerages

Crowdfunding platforms

Charity and donation platforms

Car wash networks

Spas and salons

EV charging networks

Marketing agencies

Youth and amateur sports organizations

Sports academies and training centers

Sports influencer and sponsorship payouts

Affiliate and referral networks

Fitness studio franchises

Auto repair and detailing franchises

Golf courses

Retail franchises

Event management and host marketplaces

E-sports tournaments

Telehealth marketplaces

Concert and festival promoters

Event catering

Recruiting and staffing firms

Car wash networks

Spas and salons

EV charging networks

Marketing agencies

Youth and amateur sports organizations

Sports academies and training centers

Sports influencer and sponsorship payouts

Affiliate and referral networks

Fitness studio franchises

Auto repair and detailing franchises

Golf courses

Retail franchises

Event management and host marketplaces

E-sports tournaments

Telehealth marketplaces

Concert and festival promoters

Event catering

Recruiting and staffing firms

Facility management companies

Ticketing marketplaces

Music streaming and royalties

General franchise management

Waste management contracts

Maintenance and field service platforms

Bootcamps and academies

Legal service marketplaces

Theatre and cultural event organizers

Fleet and taxi cooperatives

Tutoring and mentorship networks

Multi-channel content agencies

Public transit operators

Online learning marketplaces

Scholarship and fellowship programs

Service marketplaces

Creator and influencer platforms

Professional sports leagues

Facility management companies

Ticketing marketplaces

Music streaming and royalties

General franchise management

Waste management contracts

Maintenance and field service platforms

Bootcamps and academies

Legal service marketplaces

Theatre and cultural event organizers

Fleet and taxi cooperatives

Tutoring and mentorship networks

Multi-channel content agencies

Public transit operators

Online learning marketplaces

Scholarship and fellowship programs

Service marketplaces

Creator and influencer platforms

Professional sports leagues

Construction management software

Conference and workshop organizers

Podcast networks

Parking management companies

Municipal funding systems

Valet management companies

Therapy and counseling networks

Parking under city contracts

Gig marketplaces

Fitness and wellness platforms

E-commerce marketplaces

Food delivery platforms

Home renovation marketplaces

Ridesharing and mobility platforms

Art and gallery sales

Insurance and financial advisors

Grant management platforms

Construction management software

Conference and workshop organizers

Podcast networks

Parking management companies

Municipal funding systems

Valet management companies

Therapy and counseling networks

Parking under city contracts

Gig marketplaces

Fitness and wellness platforms

E-commerce marketplaces

Food delivery platforms

Home renovation marketplaces

Ridesharing and mobility platforms

Art and gallery sales

Insurance and financial advisors

Grant management platforms

Don't see your industry? If your platform shares revenue across multiple parties, Fintiq can help. Contact us

Why Teams Choose Fintiq

Stop losing time and money on manual payment reconciliation. See what changes when you automate with Fintiq.

Payment Processing Time

Without Fintiq

7-14 days manual reconciliation

With Fintiq

Next-day ACH with real-time visibility

Money Transmitter Licensing

Without Fintiq

$100K+ per state licensing required

With Fintiq

Zero licensing—FBO architecture keeps you compliant

Implementation Timeline

Without Fintiq

24 months + $400K-800K to build in-house

With Fintiq

2-4 weeks API integration, fixed pricing

Payment Transparency

Without Fintiq

Manual spreadsheets, frequent disputes

With Fintiq

Real-time dashboards with itemized breakdowns

KYC/KYB & AML Compliance

Without Fintiq

Build verification systems, hire compliance team

With Fintiq

Automated KYC/KYB, AML monitoring, audit trails

Frequently Asked Questions

Everything you need to know about integrating automated payment distribution with Fintiq.

Most platforms integrate Fintiq in 2-4 weeks. The process involves: (1) Setting up API authentication in sandbox environment, (2) Creating merchant and recipient records via API, (3) Testing transaction allocation logic, (4) Configuring webhook endpoints for real-time updates, and (5) Moving to production. This is significantly faster than the 18-24 months required to build in-house payment infrastructure.

Merchants are business entities that can operate under multiple locations. Each merchant receives a unique Fintiq bank account number where payment processors deposit funds for distribution. Merchants also have wallets that receive transaction remainders after your platform's allocation instructions are processed. Recipients are anyone who receives allocated funds—individual earners (stylists, drivers, service providers), partners, or even your platform. For example, in a salon transaction: the salon is the merchant (receives unique account number for deposits and remainder after allocations), while stylists are recipients (receive their allocated portions). Your platform configures payout schedules for all parties.

Your platform configures payout schedules (daily, weekly, or monthly) for recipients. After your platform sends transaction allocation instructions via API, Fintiq updates wallet balances instantly (virtual accounting). When the payout schedule triggers, Fintiq processes ACH transfers directly to each recipient's verified bank account. Funds typically arrive in 1-2 business days via standard ACH. Recipients must complete profile verification, pass KYC/AML checks, and link a verified bank account before payouts process.

Yes. Your platform sends allocation instructions via API specifying who gets what from each transaction. You can use fixed dollar amounts ($20 to stylist), percentages (15% to owner), or combinations. Multiple recipients can receive allocations from a single transaction—for example, delivery fee + tip to driver, platform commission to your wallet, and food revenue to restaurant. Fintiq automatically calculates the merchant's remainder after all allocations. The system supports multi-level commission structures, tip pooling, revenue sharing, and franchise royalty splits.

Yes. Fintiq is payment-processor agnostic and works downstream from your existing processor (Stripe, Square, PayPal, etc.). You continue processing payments as usual. Fintiq provides merchants with dedicated account/routing numbers. Merchants instruct their payment processor to settle funds into their Fintiq account. Your platform then tells Fintiq how to allocate those funds via API. This separation means you can keep your current payment setup while adding automated disbursement capabilities.

Fintiq handles payment infrastructure compliance: KYC/AML verification for all recipients (identity verification, sanctions screening, PEP checks), KYB verification for merchants, money transmitter licensing, AML transaction monitoring, and banking partner relationships. Complete transaction history exports with compliance-ready audit trails are available for your regulatory needs. Tax reporting obligations (1099 forms, business tax filings) and industry-specific regulations remain your platform's responsibility.

Start Building with Fintiq

Launch automated payment splits in 2-4 weeks with our API. Skip money transmitter licensing. Avoid building banking infrastructure. Your platform stays out of the money flow.

Join platforms automating millions in payment distributions with Fintiq